Equity

Hedged equity/arbitrage

Debt

| Scheme Name | TATA BALANCED ADVANTAGE FUND |

| Investment Objective | The investment objective of the scheme is to provide capital appreciation and income distribution to the investors by using equity derivatives strategies, arbitrage opportunities and pure equity investments. |

| Type of Scheme | An open ended dynamic asset allocation fund |

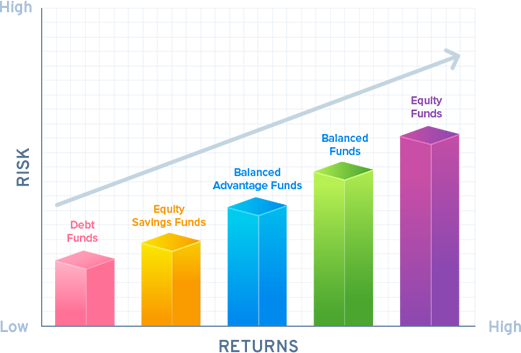

| Category of Scheme | Balanced Advantage |

| Benchmark | CRISIL Hybrid 50+50 - Moderate Index |

| Min. Investment Amount | Rs. 5,000/- and in multiple of Re.1/- thereafter |

| Load Structure | Entry Load: N.A.; Exit Load:

|

| Plans & Options | Regular & Direct Plans with Growth & Dividend Options |

Fund Managers

Equity

Hedged Equity/Arbitrage

Debt

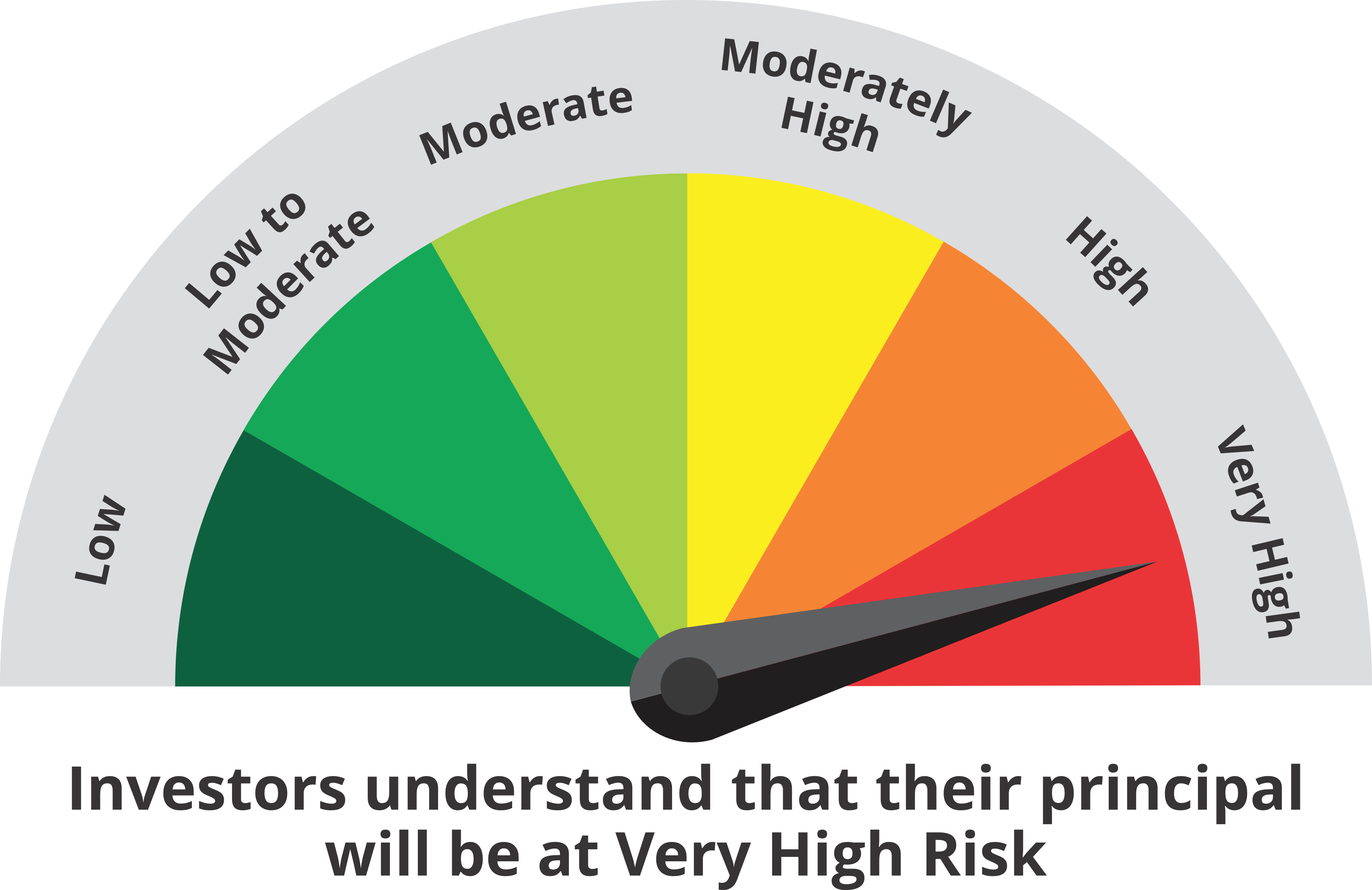

This Product is suitable for investors who are seeking*:

Investors should consult their financial advisors if in doubt about Whether the product is suitable for them.

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051